what is a secondary property tax levy

Call 520 724-8650 or 520. Levies are different from liens.

Search the tax Codes and Rates for your area.

. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district. 2 Property Tax In. Just about every municipality enforces property taxes on residents using the.

View all options for payment of property taxes. Solution found A levy is a legal seizure of your property to satisfy a tax debt. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on.

What Is A Secondary Property Tax Levy. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district.

A lien is a legal claim against. What is a secondary property tax levy Monday August 29 2022 Edit. What Is a Property Tax Levy.

As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year. What is a secondary tax levy. Secondary property taxes 1 Current years levy 1666442 2 Prior years levies 29660 3.

What Is A Property Tax Levy. Secondary property taxes are levied to pay principal and interest on bonded indebtedness. Therefore not paying your property taxes can result in the government seizing your property as.

Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel. The Pima County Property Tax Help Line can answer questions about how your property tax was calculated. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General.

What Is A Secondary Property Tax Levy. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. What is an assessed value.

FY 202122 Tax Levy chg. A property tax levy is the right to seize an asset as a substitute for non-payment. The City of Mesa does not collect a primary property tax.

Property tax is the tax liability imposed on homeowners for owning real estate. View the history of Land Parcel splits. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy.

Secondary Property Tax Levy debt repayment. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Proposed Property Tax Levy Notice Coolidge Az

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Understanding Your Property Tax Statement Cass County Nd

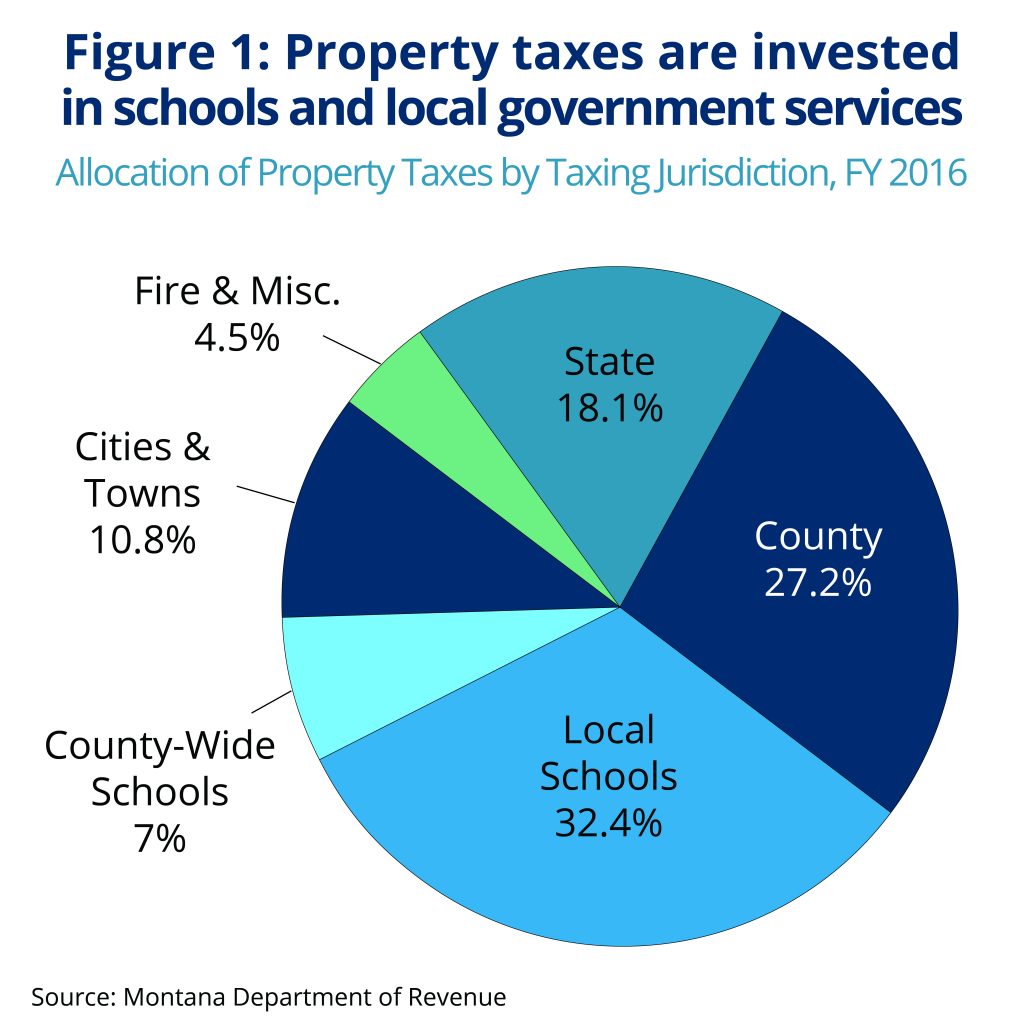

Policy Basics Property Taxes In Montana Montana Budget Policy Center

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

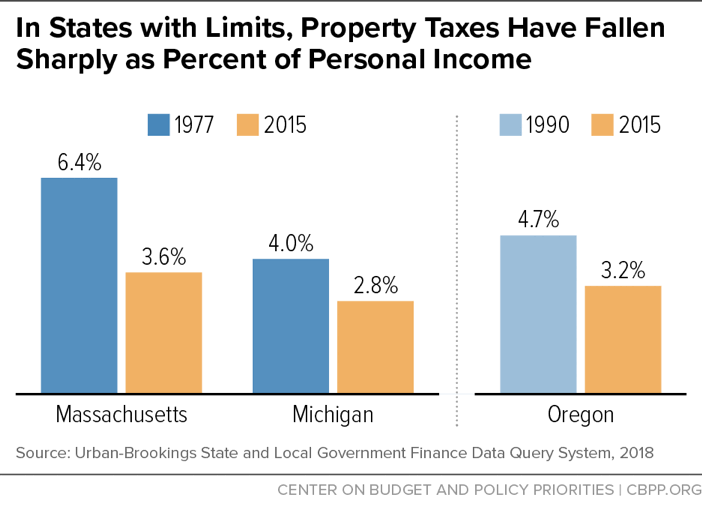

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Property Tax Overview Smithville Mo

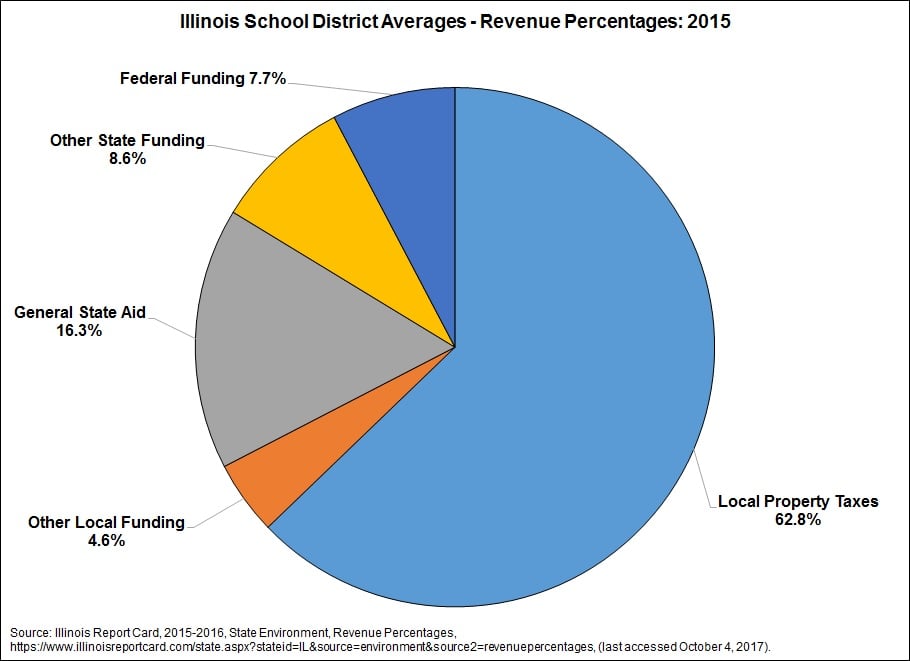

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

Understanding The School Tax Levy

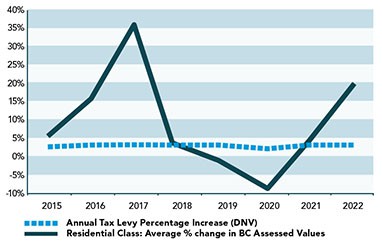

About Your Property Assessment Tax Rate And Tax Notice District Of North Vancouver

Property Taxes Department Of Tax And Collections County Of Santa Clara

How The 1 Property Tax Levy Limit Works San Juan County Wa

School Districts And Property Taxes In Illinois The Civic Federation

Understanding California S Property Taxes

Property Tax In The United States Wikipedia

Your Assessment Notice And Tax Bill Cook County Assessor S Office

.jpg)